When the US federal government blacklisted Huawei Technologies Carbon monoxide. as a nationwide security risk, it cut the Chinese company off from buying American semiconductors and various other critical technologies. Currently Huawei may have a course about those limitations.

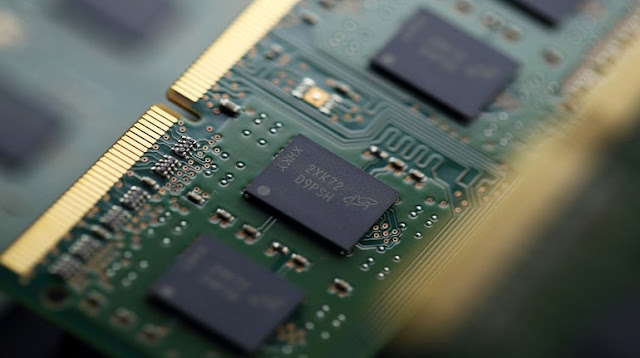

The Chinese technology giant is providing support to a start-up in its home town of Shenzhen that has ordered chipmaking equipment -- consisting of from international providers -- for a semiconductor factory, inning accordance with individuals acquainted with the issue. The recently established firm, Pengxinwei IC Manufacturing Carbon monoxide., is run by a previous Huawei exec and is building centers shut to Huawei head office, inning accordance with public documents and satellite pictures.

Huawei is expected to buy most, otherwise all, of its output, said individuals, that asked not to be determined discussing private information. PXW, as the company is known, plans to take delivery of the equipment as very early as the first fifty percent of 2023, among individuals said.

If it is successful in leaving the ground, the start-up could effectively enable Huawei to sidestep Washington's initiatives to choke off the flow of chips to a business it deem an armed forces and financial risk. Huawei representatives decreased to remark.

The low-profile PXW has currently attracted the attention of the US Business Department's Bureau of Industry and Security, which helps supervise American profession limitations.

The division knows the start-up and "allegations of connections with Huawei," BIS said in reaction to a Bloomberg Information inquiry. "BIS is constantly looking for initiatives to evade export manages, consisting of those relates to celebrations on the Entity List such as Huawei, and uses open-source, exclusive and classified information to validate and after that, when appropriate, use our management or bad guy police as well as regulative devices to address infractions."

It is unclear whether PXW's tactical plans clearly violate US profession permissions. If the firm means to provide Huawei, it would certainly be seriously limited in what chipmaking equipment it can purchase from American providers. It has more latitude to buy devices from international providers such as ASML Holding NV and Tokyo Electron Ltd., however they too may need to look for US authorization depending upon the quantity of American technology instilled right into any items sold.

PXW said in a declaration it is tattooed contracts with providers and aims to start manufacturing in 2025, without mentioning customers. The company plans to begin functioning on its 28-nanometer technology -- 6 generations behind one of the most advanced manufacturing -- next year, said a single person acquainted with its strategy.

Huawei, perhaps greater than other company, is at the heart of US-China stress. The Surpass management blacklisted the company in 2019 and pushed allied countries such as the UK and Japan to remove its telecommunications equipment from concern maybe used for snooping and espionage. The dispute escalated with initiatives to prosecute Huawei's chief monetary policeman, the child of creator Ren Zhengfei, on scams charges. (Meng Wanzhou, that rejected misdeed, was enabled to leave Canada for China in 2015 under a deferred prosecution contract.)

Huawei has paid a hefty price. Before the blacklisting, the company was the world's biggest provider of mobile interactions equipment and contended with Apple Inc. and Samsung Electronic devices Carbon monoxide. in the mobile phone business. Its chip design unit, HiSilicon, was a foundation of China's attempts to develop a vibrant residential semiconductor industry. The US activities owned Huawei from many abroad markets, forced it to sell off its mass-market telephone business and cut off its access to chips important to its success. Ren said this year in an interior worker memo the company is finding it progressively challenging to expand in the face ofin the face of American permissions.

PXW will not have the ability to develop a chip-making business to suit abilities of Taiwan Semiconductor Manufacturing Carbon monoxide., the industry leader that once provided Huawei. But the start-up could help Huawei restore ground in several critical locations, such as mobile phones and web servers. It is unclear whether the company is using any possessions, intellectual property or individuals from HiSilicon.

Head of state Joe Biden's management is preparing new limitations on China's access to chip technology that could affect PXW and comparable situations. The Business Division plans to present a bundle of rules as quickly as today tightening up curbs on semiconductor technologies that can be exported to China, individuals acquainted with the issue have said.

The US federal government is moving past blacklisting individual companies such as Huawei and Semiconductor Manufacturing Worldwide Corp. for wide limitations on all Chinese companies, consisting of a ban on purchases of artificial-intelligence chips. The White House is also considering an exec purchase to place curbs on US financial investment in Chinese technology companies.

"We formerly maintained a ‘sliding scale' approach that said we need to stay just a pair of generations in advance. That's not the tactical environment we remain in today," Jake Sullivan, the US Nationwide Security Consultant, said last month. "Provided the fundamental nature of certain technologies, such as advanced reasoning and memory chips, we must maintain as large of a lead as feasible."

In China, the Huawei episode galvanized Communist Party initiatives to develop a residential semiconductor industry, a enduring objective to better take on the US in advanced technologies. The federal government has poured 10s of billions of bucks right into the industry. Huawei itself has purchased greater than 40 chip-related companies, inning accordance with a research study record from Berenberg Financial institution.

"Although Huawei doesn't own any manufacturing centers in the meantime, it's mosting likely to be among the essential companies in driving China's semi industry because of its items in end-markets such as networking, expert system computation, shadow, mobile phones, IoT and auto," Tammy Qiu, an expert at Berenberg, composed in the record in September.

PXW is backed by the same Shenzhen city federal government that assisted take control of Huawei's Recognize mobile phone department in 2020. The start-up acquired enough land in the city to cover greater than 30 football areas in December, and paid 158 million yuan ($23 million), inning accordance with land purchase information and its own website. Satellite photos show structures on the website are nearing conclusion, but what's unclear is what equipment will be installed inside them and where the equipment will come from.

The marketplace for chipmaking equipment is controlled by 5 companies -- the Netherlands' ASML and Japan's Tokyo Electron, as well as the US's Used Products Inc., KLA Corp. and Lam Research Corp. All them go through complicated regulations that limit what they can sell to Huawei and various other Chinese customers. Generally, the American companies are barred from selling equipment to Chinese customers advanced compared to 14 nanometers -- 4 generations behind the newest technology. US companies can't sell anything to Huawei without an unique license.

Used Products isn't providing the Chinese start-up, inning accordance with an individual acquainted with the issue. Representatives for Used and Lam Research decreased to discuss PXW. KLA said in a declaration that it adheres to US profession regulations, consisting of limitations on individual companies and their affiliates.

ASML, which controls the marketplace for lithography equipment, decreased to say if it's functioning with PXW and said it is up to customers to reveal their providers. A Tokyo Electron agent said the company has not listened to of PXW.

PXW is targeting 14- and 7-nanometer manufacturing, much less advanced compared to the abilities of companies such as TSMC and Samsung, but still a difficulty for Chinese chipmakers, inning accordance with a single person acquainted with its plans. It is uncertain how PXW could secure such technologies.

Non-American companies such as ASML and Tokyo Electron remain in murky area when it comes to companies blacklisted by the US, such as Huawei. If their chip-making equipment includes US technology past a specific quantity, they are limited from selling to a client they know works with a blacklisted company, inning accordance with Judith Alison Lee, a companion at the law practice Gibson Dunn & Crutcher.

"Foreign-made items may integrate a de minimis quantity of US-origin content" -- typically 25% -- without dropping under the limitations, she said.

Kevin Wolf, a previous elderly official at BIS and currently a companion at Akin Gump Strauss Hauer & Feld, said that, under today's regulations, companies such as ASML and Tokyo Electron can probably produce most of their chip-making equipment without going across that limit.

"It is not likely that the non-US companies would certainly obtain captured in any one of the Huawei-specific rules," he said.

The Biden administration's new limitations could change that however. They may decide to obstruct international companies from selling chip-making equipment to Huawei providers if those companies use any American elements or software.

PXW has employed a variety of elderly designers from chip titans consisting of China's Hua Hong Semiconductor Ltd. and Taiwan's Unified Microelectronics Corp., inning accordance with a employment video clip posted on jobs website Liepin. It has also hired designers from Hongxin Semiconductor Manufacturing Carbon monoxide., a $20 billion chip project that broke down in late 2020, inning accordance with an individual acquainted with the issue. The young company aims to hit capacity of 20,000 wafers by 2025, the company said on its website, without elaborating on the duration.

A Chinese factory qualified of production 14-nm chips might suffice for Huawei. Many elements of networking equipment -- transceivers, application-specific incorporated circuits and switch chips -- are made keeping that technology.

While Huawei's mobile phone business is kneecapped by U.S. permissions, it's still able to expand its telecommunications facilities business. TSMC dropped Huawei as a client in 2020, removing access to a key manufacturing companion for the chips that enter into phones and web servers.

PXW could resume provide networks, individuals said, if Washington does not take further activity. The US Bureau of Industry and Security decreased to say whether it has approved or declined licenses for any equipment manufacturers to provide PXW.

Taiwan's Ministry of Financial Events said while PXW has not been put on its entity list for modern exports, no Taiwanese company has stated any shipments to the Chinese chipmaker over the previous 3 years. The ministry included that Taiwan is tipping up initiatives to clamp down on Chinese companies poaching Taiwanese skill.

Posting Komentar